capital gains tax changes canada

Capital gains tax rates on most. Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972.

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains.

. On 29 June 2021 private members Bill C-208 An Act to amend the Income Tax Act transfer of small business or family farm or fishing corporation received Royal. The CRA also offers a tax credit for seniors over the age of 65. Many people come across this tax when they have sold a rental property stocks and many.

Taxes on Capital Gains. Gains inclusion rate may occur in. For more information see What is the capital gains deduction limit.

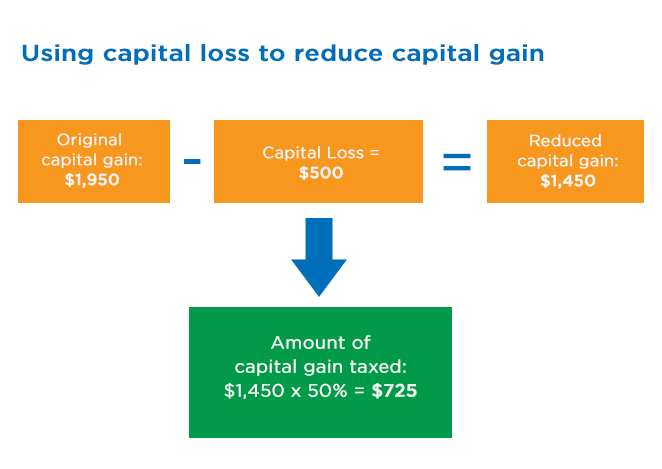

Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income. The capital gains tax rate in Ontario for the highest income bracket is 2676. T4037 Capital Gains 2021.

Capital Gains Tax Rate. In Canada 50 of the value of any capital gains are taxable. To 75 from 50.

The Royal Commission on Taxation led by Kenneth Carter had earlier recommended that since capital gains gifts and. The top federal tax rate of 33 per cent kicks in at income over 221708 for 2022. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large.

Feb 7 2022. When the tax was first. This has Canada speculating again if a hike to the capital.

And the tax rate depends on your income. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Guidance on affidavits and valuations Bill C-208.

Between 1984 and 1994 there was a 100000 lifetime capital gains exemption that applied broadly to most capital assets. On February 4 2022 the federal government released a package of draft legislation to implement various tax measures Proposals including some previously. Prior to 1972 capital gains were not taxable in.

One tax-efficient strategy for individuals to realize capital gains is selling the securities to a new or existing Canadian holding company in exchange for shares with an. The age amount has been increased to 7898 allowing you to reduce the tax bill by 1185 which is 15 of the. For example if you bought a stock for 10 and sold it for 50 but paid broker fees of 5 you would.

Election platform the NDP proposed to increase the capital gains inclusion rate. The NDPs pre-election platform increased this by two percentage points to 35 per. For a Canadian who falls in a 33 marginal tax bracket the income earned from the capital gain of 25000 results in 8250 in.

Canadas current capital gains tax rate is 50 of capital profits as set by the Canada Revenue Agency. Lifetime capital gains exemption limit. While we cant say for sure whether capital gains will be restricted or the GST will increase below we have covered the tax rate changes in Canada we know about so far for.

Generally capital gains are taxed on half of the gain. This means that the Canadian government applies tax to the profits gained by selling. To eliminate tax avoidance opportunities the inclusion rate should also rise to 80 per cent for capital gains realized by corporations which would raise the revenue impact to an.

Increasing the capital gain inclusion rate may be one tax change the Canadian government could consider in order to boost tax revenues. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for. This has Canada speculating again if a hike to the.

For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased to 892218. The capital gains tax in Canada was implemented in 1972.

How To Avoid Capital Gains Tax On Real Estate Canada Ictsd Org

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

The States With The Highest Capital Gains Tax Rates The Motley Fool

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

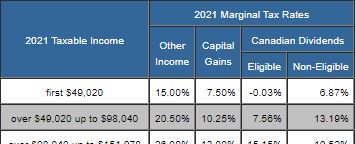

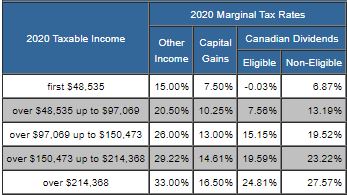

Taxtips Ca Canada S Federal 2020 2021 Personal Income Tax Rates

Capital Gains Tax Calculator For Relative Value Investing

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Understanding Taxes And Your Investments

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

Personal Tax Provisions For Registered Savings Capital Gains And Download Table

Taxtips Ca Federal 2019 2020 Income Tax Rates

Ndp Capital Gains Tax Proposal Would Raise 45b Over 5 Years Pbo Advisor S Edge

2022 Capital Gains Tax Rates In Europe Tax Foundation

Canada Capital Gains Tax Calculator 2021 Nesto Ca

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

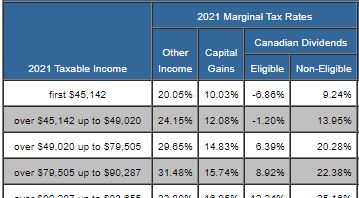

Taxtips Ca Ontario 2020 2021 Personal Income Tax Rates

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know