south dakota property tax records

If your taxes are delinquent you will not be able to pay online. Please notate ID wishing to pay.

Property Tax South Dakota Department Of Revenue

Property Search and Mapping.

. In the year 2011 property owners will be paying 2010 real estate taxes Real estate tax notices are mailed to property owners in January. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette CountyFor more details about the property tax rates in any of South Dakotas counties choose the county from the interactive map or. The fee for the search is 2000 plus a fee for copies whether emailed or hard copy.

An individual will receive instructions and assistance on the Index books. The Treasurers Office is best known by the public for collecting real estate taxes. Free access to property tax information.

With this article you will learn important knowledge about South Dakota property taxes and get a better understanding of things to consider when it is time to pay. Real estate taxes are paid one year in arrears. Property assessments are public information.

Property owners may review the information that the county office has on. South Dakota law requires the equalization office to appraise property at its full and true value as of November 1 of each year. Find Out Whats Available.

The money from the taxation of these vehicles is collected and remitted to the state of South Dakota. Get In-Depth Property Reports Info You May Not Find On Other Sites. Lincoln County has entered an agreement with GovTech Service Inc for online property tax payments.

Look Up Any Address in South Dakota for a Records Report. Ad Our Search Covers City County State Property Records. Search Union County property tax and assessment records by name address or parcel ID or search parcel map.

Taxes in South Dakota are due and payable the first of January however the first half of property tax payments are accepted until April 30 without. To protect your privacy this site uses a security certificate for secure and confidential communications. Our property records tool can return a variety of information about your property that affect your property tax.

To 5 pm Monday - Friday. Payments can be mailed to Pennington County Treasurer PO Box 6160 Rapid City SD 57709. Use our free South Dakota property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics.

Search by parcel ID house number or street address. Search Any Address 2. The Treasurer is not only responsible for collecting property taxes for the county but the city and school districts as well.

Up to 38 cash back South Dakota Property Records. Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year. Motor vehicle fees and wheel taxes are also collected at the County Treasurers office.

In addition to collecting taxes and other forms of revenue the Treasurer issues distress warrants for the State of South Dakota for non-payment of sales taxes or unemployment insurance and delinquent taxes on mobile homes. 209 East Main St Suite 130 Elk Point SD 57025. Union County Director of Equalization.

RecordEASE is the countys commercial product for accessing land records maintained by the County Recorder and Registrar of Titles Office of Dakota County. The Property Tax Division is responsible for overseeing South Dakotas property tax system including property tax assessments property tax levies and all property tax laws. Motor vehicle collections are divided between the county cities townships and the state of South Dakota.

This value is reflected to the market value in which most people would likely pay for a given property in its present condition. Vehicle Renewals with last name ending in F G J are due by March 31st. The state of South Dakota has a population of 814180 whose dwelling spaces fall into two distinct categories as defined by the US Census.

A South Dakota Property Records Search locates real estate documents related to property in SD. Assessor Director of Equalization. See Property Records Deeds Owner Info Much More.

This is done using mass appraisal techniques. South Dakota is ranked number twenty seven out of the fifty states in order of the average amount of property taxes collected. This site is designed to provide you with additional methods to research your property information and to allow you to pay your property taxes online.

For an additional convenience fee listed below you may pay by ACH or credit card. There are 64 Assessor Offices in South Dakota serving a population of 855444 people in an area of 75791 square milesThere is 1 Assessor Office per 13366 people and 1 Assessor Office per 1184 square miles. Payment is required at time of service.

Whether you are presently a resident just contemplating taking up residence in South Dakota or planning on investing in its property find out how local property taxes work. The county treasurer also collects property taxes for the county city school districts and any other political district authorized to levy real estate taxes. The below is solely intended for informational purposes and in no way constitutes legal advice or specific recommendations.

REAL ESTATE TAX INFORMATION. Property taxes are the primary source of funding for schools counties municipalities and other units of. Any person may review the property assessment of any property in South Dakota.

Property Information Search. Convenience fees 235 and will appear on your credit card statement as a separate charge. The state of South Dakota is ranked 2nd in Assessor Offices per capita and 37th in Assessor Offices per square mile.

Please call the Treasurers Office at 605 367-4211. Go to Property Information Search. If you are unable to visit our office a last document search request may be made by email or phone and will be conducted as time permits.

Households and group quarters. Property Tax Assessment Process. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000.

The Pennington County Equalization Department maintains an onlinesystem wherethe public can review property assessments and property information. See Results in Minutes. If you would like to pay your Property Tax by credit card we accept Discover Visa and Mastercard.

Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property.

Property Tax South Dakota Department Of Revenue

Mchenry County North Dakota Departments

Fall River County South Dakota 906 N River Street Hot Springs Sd 57747

Property Assessment Oglala Lakota County South Dakota

Property Tax South Dakota Department Of Revenue

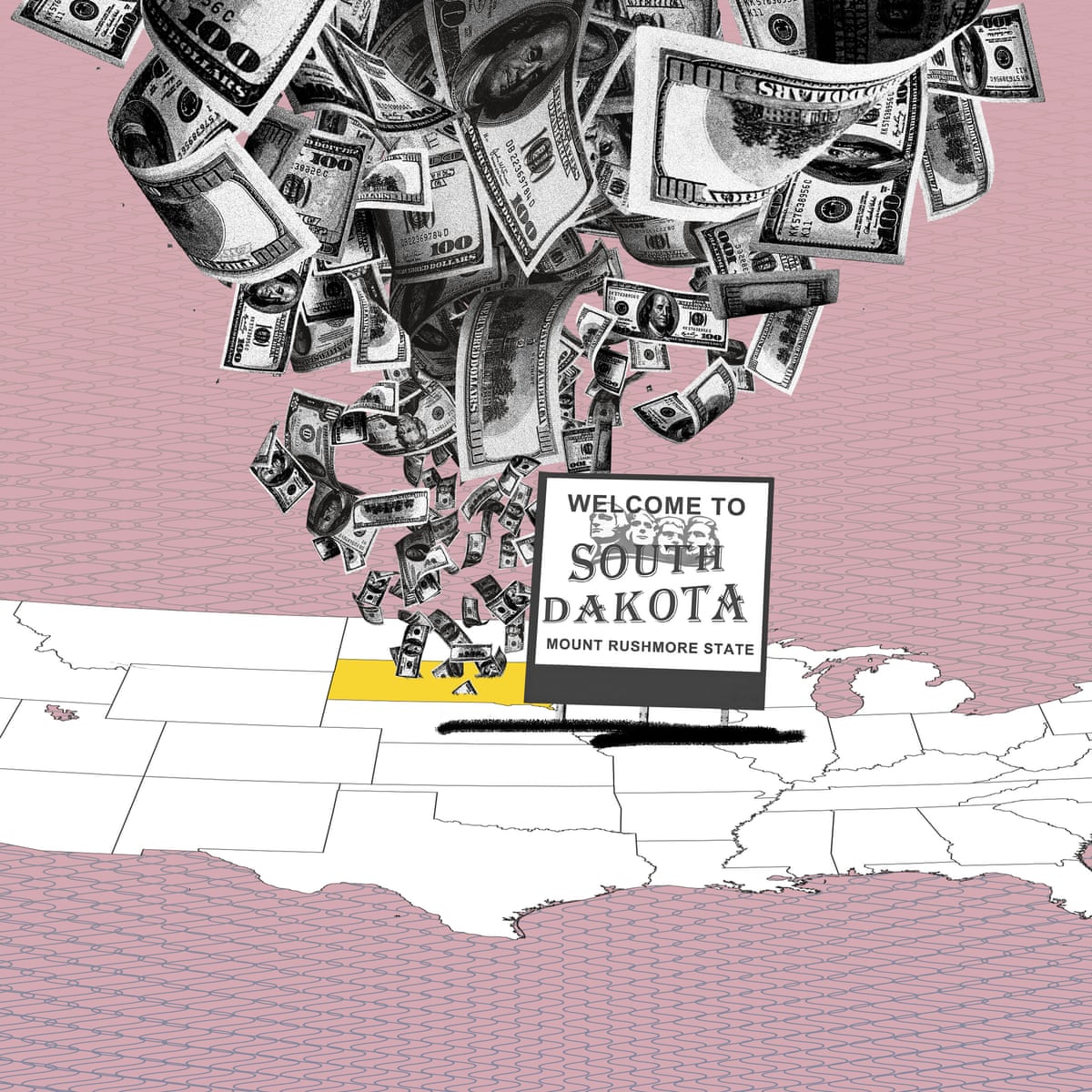

Pandora Papers Reveal South Dakota S Role As 367bn Tax Haven Us News The Guardian

South Dakota Deed Forms Eforms

Register Of Deeds South Dakota Department Of Revenue

Understanding Your Property Tax Statement Cass County Nd

South Dakota Deed Forms Eforms

South Dakota First Time Homebuyer Assistance Programs Bankrate

Property Tax South Dakota Department Of Revenue

How To Get A Certificate Of Exemption In South Dakota Startingyourbusiness Com

Free South Dakota Quitclaim Deed Form How To Write Guide

Free South Dakota General Warranty Deed Form Word Pdf Eforms

Director Of Equalization South Dakota Department Of Revenue

South Dakota Property Tax Calculator Smartasset

Property Tax South Dakota Department Of Revenue

South Dakota Public Records Directory Official Documents Directory